Financial inclusion is the driver of Fintech Revolution- The Prime Minister of india, Shri. Narendra Modi said at the Infinity Forum inaugural today. Fintech is resting on 4 pillars; income, investments, insurance, and institutional credit. When income grows, investment becomes possible. Insurance coverage enables greater risk taking ability and investments.

India has proved to the world that it is second to none when it comes to adopting technology or innovating around it. Transformational initiatives under Digital India have opened doors for Fintech innovations to be applied in governance.

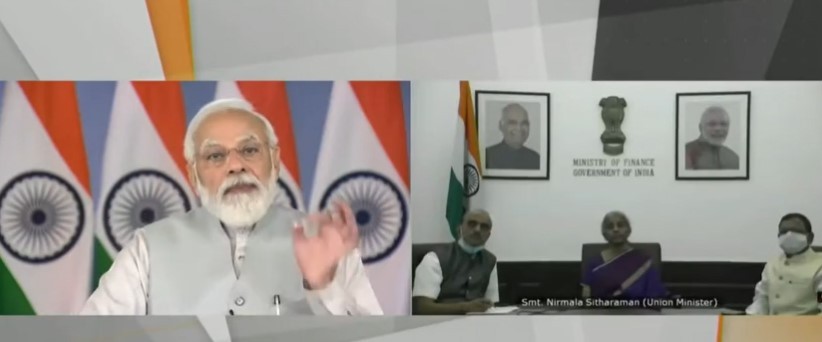

Prime Minister Modi speaking at the ‘Infinity Forum‘ said the forum represents the immense possibilities that Fintech has in India. It also shows the huge potential for India’s Fintech to provide benefits to the entire world.

‘InFinity Forum’ on fintech today; over 70 countries to participate

We believe in sharing our experiences and expertise with the world and learning from them as well. Our Digital Public Infrastructure solutions can improve the lives of people around the world. Tools like UPI and RuPay provide an unparalleled opportunity for every country. An opportunity to provide a low cost and reliable ‘real time payment system’ as well as a ‘domestic card scheme’ and ‘fund remittance system’. Prime Minister of India , Shri. Narendra Modi said at the Infinity Forum

Technology has also catalyzed financial inclusion – PM Modi at Infinity Forum on Fintech

From less than 50% Indians having bank accounts in 2014, we have almost universalized it with 430 million Jan Dhan accounts in the last 7 years. So far, 690 million RuPay cards have been issued. RuPay cards clocked 1.3 billion transactions last year. UPI processed around 4.2 billion transactions in just last month.

He further said, Institutional credit gives wings for expansion. And we have worked on each of these pillars. When all these factors come together, you suddenly find so many more people participating in the financial sector. The large base becomes the perfect springboard for Fintech innovations.

Fintech industry in India is innovating to enhance access to finance and the formal credit system to every person in the country. Now it is time to convert these fintech initiatives into a fintech revolution. A revolution that helps to achieve financial empowerment of every single citizen of the country.

Almost 300 million invoices are uploaded on the GST portal every month. More than 12 billion US dollars worth payment is done through the GST portal alone every month. Despite the pandemic, about 1.5 million railway tickets get booked online everyday. Last year, FASTag processed 1.3 billion seamless transactions. PM Svanidhi is enabling access to credit for small vendors across the country. e-RUPI has enabled targeted delivery of specified services without leakages; I can go on and on, but these are just a few examples of the scale & scope of Fintech in India.