The Adani Group, an Indian conglomerate, is now facing a regulatory scrutiny in the United States following allegations of stock manipulation made by a prominent short seller.

The US Attorney’s Office in Brooklyn, New York, has initiated inquiries in recent months directed at institutional investors who hold significant stakes in the Adani Group, according to an individual familiar with the matter.

The focus of the inquiries is to ascertain the information provided by the Adani Group to its American investors in light of a damning report by the short seller, which accuses the conglomerate of clandestinely manipulating its share prices through offshore companies. The person, who requested anonymity due to the ongoing nature of the investigation, disclosed that the Securities and Exchange Commission (SEC) is also conducting a similar probe.

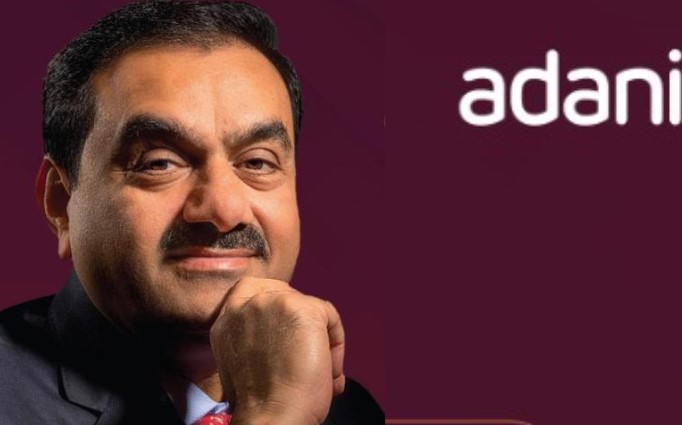

Adani Group after Indian Scrutiny Now Faces US Regulator

It should be noted that requests for information from US prosecutors do not necessarily imply imminent criminal or civil actions, as such inquiries are frequently initiated without resulting in further proceedings according to business standard report.

This heightened attention from US authorities adds to the existing scrutiny faced by the Adani Group, one of India’s largest conglomerates. Hindenburg Research, the short seller responsible for the report, alleged long-standing stock manipulation and accounting fraud within the group. As a result, the Adani Group is currently facing regulatory investigations in its home country.

Coinciding with these developments, President Joe Biden recently hosted Indian Prime Minister Narendra Modi at the White House. Both Gautam Adani, the billionaire leading the Adani Group, and Modi originate from the western Indian state of Gujarat. The rapid growth of Adani’s business empire mirrors Modi’s own political journey to becoming India’s head of government.

A spokesperson for the Adani Group, headquartered in Ahmedabad, India, stated that the company has no knowledge of any subpoenas issued to its investors.