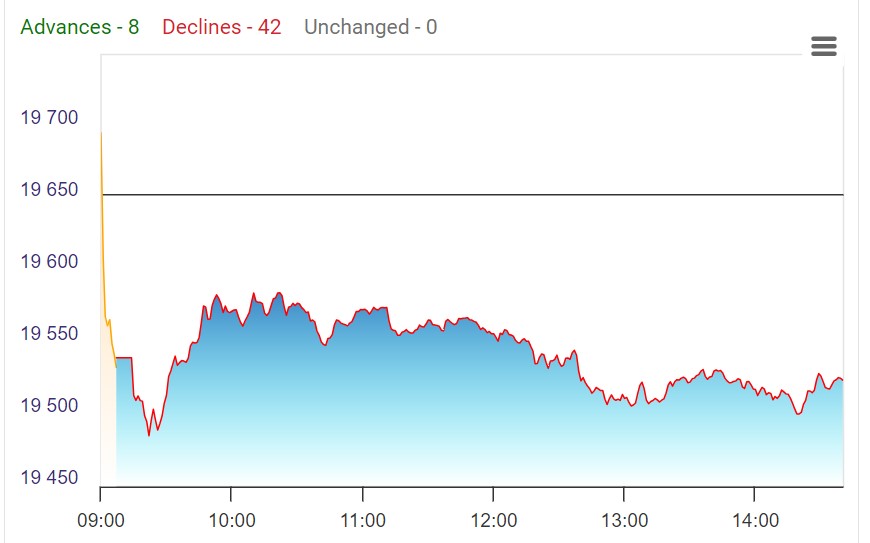

The Nifty 50 witnessed fluctuations in today’s stock indices with the BSE Midcap and Smallcap indices experiencing a 1-1.5% dip. However, some notable gainers on the Nifty included HCL Technologies, Dr Reddy’s Laboratories, TCS, ONGC, and HUL.

Conversely, the losers featured Adani Ports, Hero MotoCorp, BPCL, HDFC Life, and SBI.

Ambuja Cements Ltd saw a 1.5% decrease in its stock price following a substantial block deal. Approximately 1.3 million shares of the company changed hands, as reported in Bloomberg’s online financial market update. However, the identities of the buyers and sellers remain undisclosed.

National Fertilizers Ltd experienced a decline of over 2% on October 9th as LIC diluted its stake in the company through open market transactions. At 1:36 pm, NFL’s stock was down 2.55% to Rs 68.90. LIC reduced its stake in the company by 2.018%.

LIC disclosed in regulatory filings that it lowered its shareholding in NFL from 4,55,02,381 to 3,56,02,539 equity shares, effectively reducing its ownership from 9.275% to 7.257% in NFL. These transactions occurred from August 1 to October 6, with an average cost of Rs 70.58 per share.

Nifty 50 Updates

In other stock market news, Rail Vikas Nigam secured a Letter of Acceptance (LOA) from Maharashtra Metro Rail Corporation for the design and construction of an elevated metro viaduct. This Rs 395 crore project is expected to be completed within 30 months.

On the global front, WTI crude futures surged over 4% to surpass $85 per barrel. This price increase followed a surprise attack by Hamas on Israel over the weekend, initiating a conflict in the Middle East. While the violence remains contained within the region, there are concerns that geopolitical tensions could escalate on a global scale, with reports suggesting possible Iranian involvement in planning the attacks.

While the Nifty 50 is experiencing swings , Experts suggest that the surge in crude oil prices is likely to be temporary, as neither Israel nor Palestine is a major oil supplier. Furthermore, the conflict has not yet directly threatened major oil production or supply facilities. However, a prolonged conflict may impact crude oil prices in the short term due to its proximity to major oil-producing and exporting nations.